Three crypto Polymarket traders to follow (September 2025 Edition)

1) What

Prediction markets offer an opportunity to see the wisdom of the crowds. Our faithful Stand traders demanded a crypto edition of traders to follow our NFL writeup. Why? Crypto is the second most popular category on Polymarket with over 12,200 events (the first is sports in case you were wondering). Crypto prediction markets have blossomed into an array of questions: will Ethereum’s price be up or down within the hour? What will Bitcoin’s price be by the end of October? When will Monad airdrop its token? And so much more!

Methodology

Like our NFL write up, we will be using Stand & Polymarket Analytics, the best prediction market history book around. It’s the perfect counterpart to Stand if you consider Stand to be your Bloomberg Terminal: real-time analytics, copy trading, and an advanced trading terminal. This time, we figured we’d sprinkle in some Hashdive too! Hashdive is terrific for spotting price and P&L trends. It’s another terrific tool for the professional trader’s toolbox.

In this post, we will be looking at,

Overall Category P&L = Total Wins - Total Losses

7 & 30 Day P&L Trends = How Streaky Traders’ Are

# Total Positions = More Attempts, More Data Points

Again, there is no one, singular way to identify good traders to follow. Rankings can be misleading. We removed Win Rate after the feedback from our community who affirmed what we previously wrote; it’s easy to have a high win rate ( % of markets traded where the trader profited) when you take assumed safe bets, i.e. trading in markets that have 90% probability.

One quick caveat: each prediction market category has its own wrinkles. It’s safe to assume the traders in crypto are fiendishly advanced and likely trading directly through Polymarket’s API. What gives us the confidence to make such a claim? The frequency and precision of their trades. The traders below all typically enter around a $0.40 to $0.60 price and wait until market resolution to redeem. They trade measured amounts – varying by accounts – and typically stick to one sub-category in crypto (1 hour versus the Daily Up or Down). We mention this not because they’re not worthwhile in tracking or mirror trading, but just as a warning so you know what you’re up against.

With that said, we found three incredible crypto traders to follow, all already on Stand, and all ready to be copy traded. Let’s dig in!

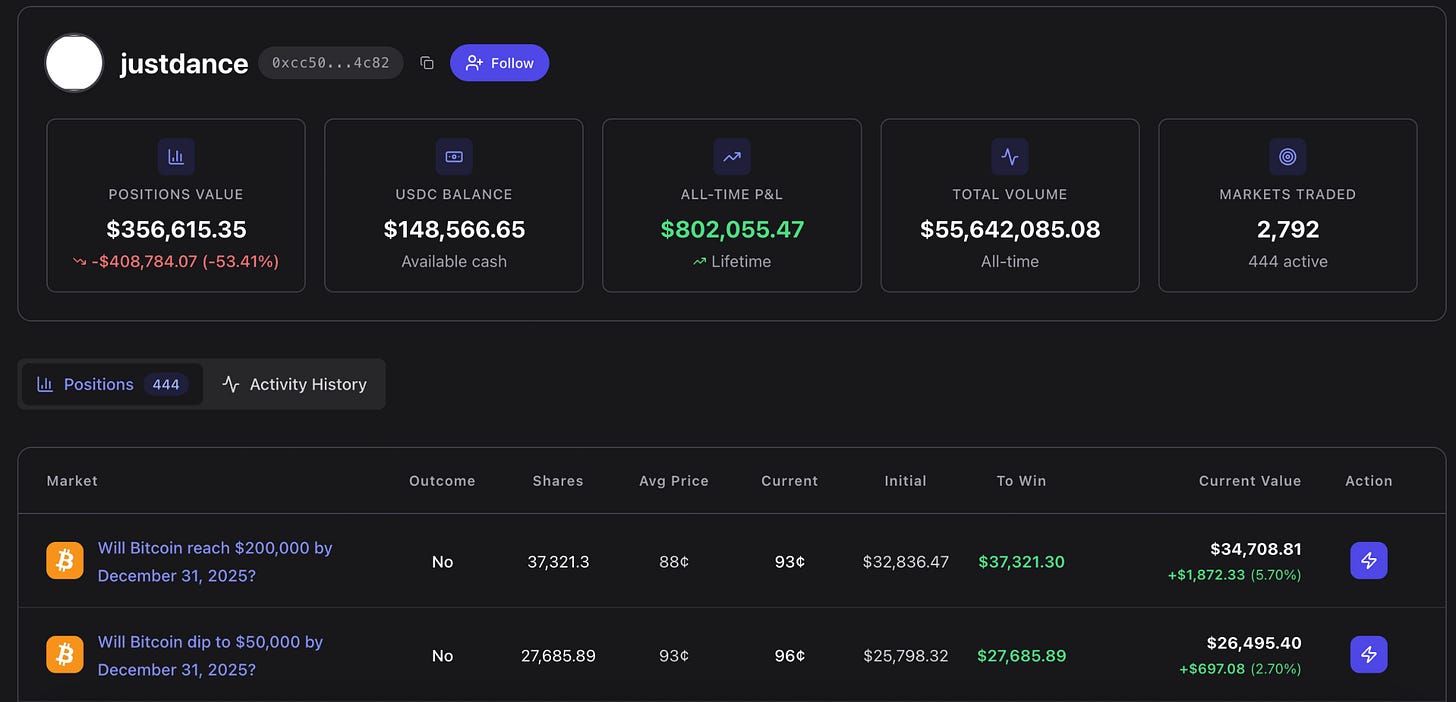

Trader #1: Justdance

Crypto P&L: $352,293

7D P&L: $30.7K

30D P&L: $6.2K

Total Crypto Positions: 3,215

Active Crypto Positions: 429

‘What’s going on on the floor?’ is not only a LadyGaga lyric but how Justdance approaches crypto prices in prediction marketland. His P&L is up a staggering 60% percent in the last month. Justdance dabbles in the blue bloods, Bitcoin and Ethereum mainly, by trying to identify their price point on a monthly cadence. And he’s shown he’s really good at it too. Interestingly enough, the markets where Justdance does the worst in is anything politics related. But if you stick to crypto, he’s your man. He’s top 10 in every crypto category with the notable exception of the hourly markets, where Dance shamefully lands at #11. Oh, and if that wasn’t enough to convince you, Justdance is the 63rd best overall trader on Polymarket according to Polymarket Analytics. Dance must be doing something right. Grab ‘em as your dance partner! The track you ask? Any of the BTC markets – although, you won’t suffer following their lead in anything with a token address. Justdance, gonna be okay, da da doo-doo-mmm…

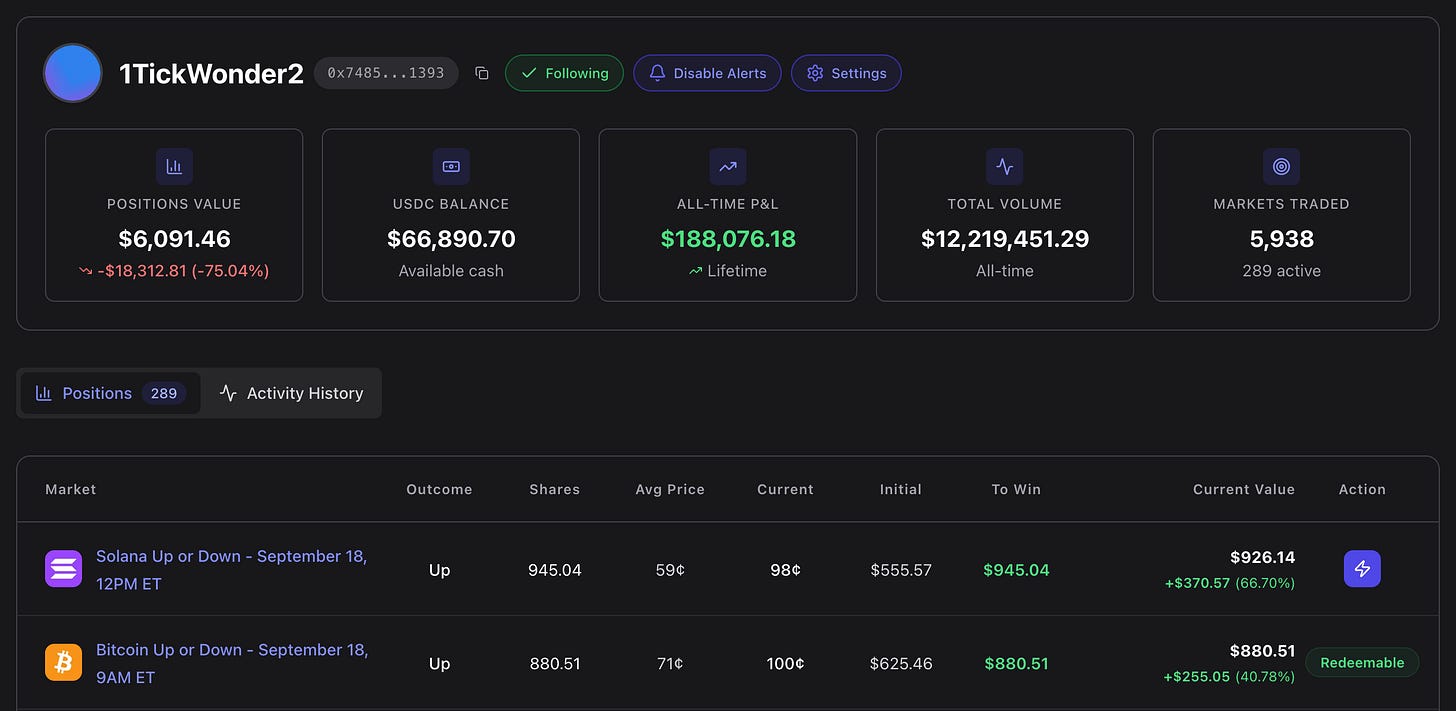

Trader #2: 1TickWonder2

Crypto P&L: $187,688

7D P&L: $5.9K

30D P&L: $35.1K

Total Crypto Positions: 11,284

Active Crypto Positions: 336

1TickWonder2 is THE trader to follow for the hourly (ex: Will Ethereum be Up or Down in 1 hr?) markets. If it’s crypto and recurring, which most of the crypto markets are, then 1TickWonder2 smashes the competition. Where is the Tick weakest? Interestingly, 1TickWonder2 has made 2 trades outside of crypto, both in Formula 1, both on the F1 Belgian Grand Prix Winner, and only 1 was a loser. It seems like the Tick knew funds were not secure as he wagered a meagerly $500. Tick hasn’t wagered on F1 since! He decided to stay within his lane and focus on Bitcoin Up or Down. We’re fairly confident he’s trading algorithmically considering the systematized nature of his trades: anywhere from $500 to $1200 typically, usually in the morning or evening hourly markets, although they can run at all hours of the day. He’s a popular account among the Stand team to watch as he continues to suck the blood out of the crypto prediction markets.

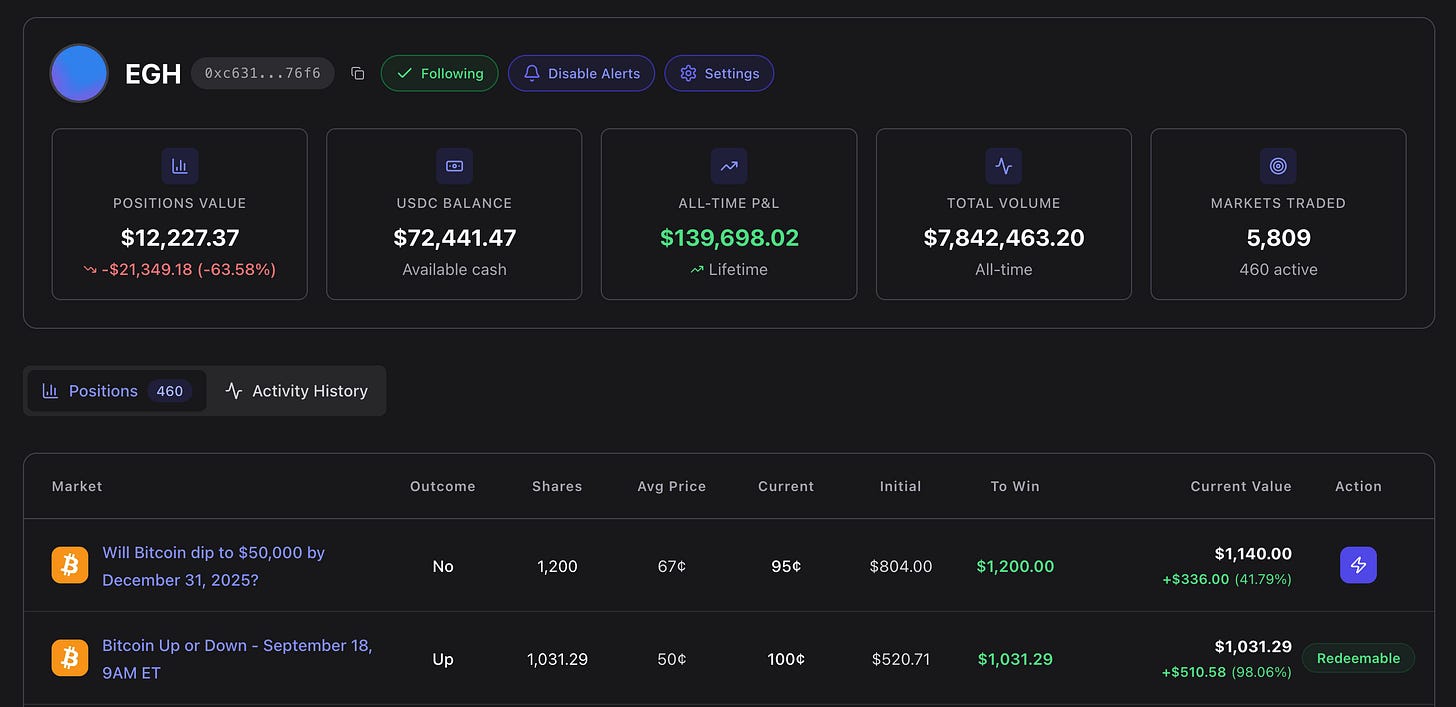

Trader #3: EGH

Crypto P&L: $131,080

7D P&L: $6.6K

30D P&L: $29.1K

Total Crypto Positions: 10,013

Active Crypto Positions: 479

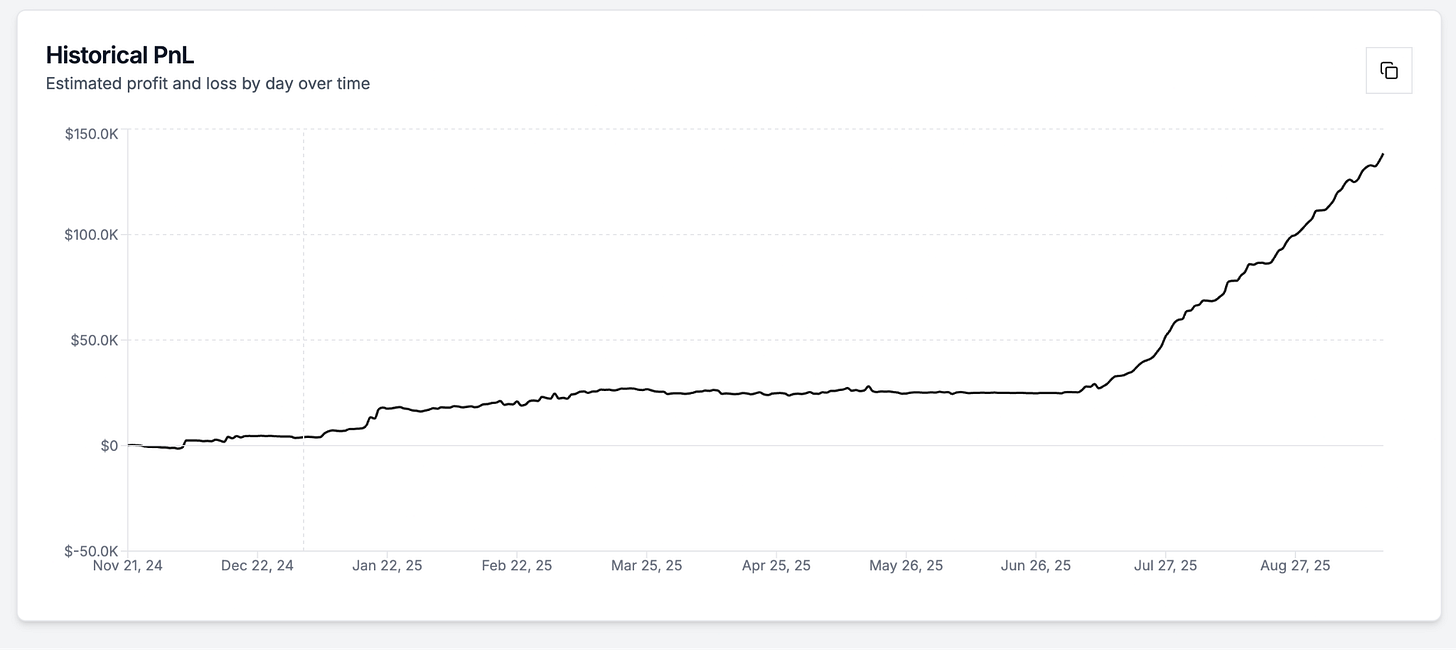

EGH’s historical P&L is a sight to behold. Up 5X since July!!! EGH has traded over $8M in volume. In that span, EGH has demonstrated a mastery in the hourly markets. Not many traders reach 10,000 positions in over 5000 markets with a positive six figure P&L (side note: this is another trader who likely is benefiting from computational resources. Bot potential?). That alone makes them a worthy follow.

EGH has dabbled in everything from the Super Bowl to Ukraine with few losses to show. There is one Achilles’ heel, and, curiously, it is in the crypto markets: XRP. Under no circumstances should you follow EGH into battle for anything Ripple related. EGH is squarely in the red there, having lost over a net $1K and a total $41K. Oddly, 1Tick suffers in the XRP markets too, so it could be a market issue. Stick to the blue blood hourly markets (BTC, ETH, & SOL) and EGH will take you to Valhalla!

In Closing

The crypto markets are an evolving space in prediction markets. Just last week, Polymarket launched 15 minute Up/Down markets after all the volume achieved from the hourly and daily markets. There are so many more traders than the three we shared here. You can copy trade them and more on Stand.trade. It’s free!

We would love to hear from you. Who did we leave off the list? What did we miss? Tell us on X.