How to Copy Trade Polymarket Whales in Real-Time

Copy Trading 101

What is Copy Trading?

Copy trading is a strategy where you automatically or manually replicate the trades of other, usually more experienced, traders. In traditional finance, it’s common in forex and stocks. Funds copy trade other funds’ positions all the time.

On Polymarket, trades happen 24 hours a day and are completely transparent–the benefit of being on-chain. This means it’s the perfect environment to copy trade top-performers across markets. You piggyback on someone else’s conviction.

The trick is…

1) knowing who to copy trade.

2) seeing when to copy trade.

3) and trading before the opportunity is gone!

In some cases, this is automated: you set parameters around another trader on how you want to follow or counter their trades. For example, say I want to copy trade all of Nancy Pelosi’s stock buys. Autopilot is a seamless way to do so. You create an account and select the politician’s portfolio you want to mirror. Autopilot does the rest.

Copy trading can also be manually performed. The beauty of crypto is that all on-chain transactions are visible. Polymarket is an on-chain prediction market, which means it’s ripe for copy trading. For example, if you see Domer buying shares of pope candidates, you don’t need to be a Papal Conclave expert. You can estimate with a high degree of confidence that Domer has done his homework. The more money he puts behind a candidate, the more convicted he is since no one would willingly wager money on a losing position.

Since prediction markets are still emerging, we encourage users to manually copy trade for reasons we will explain in detail below. We built Stand to help you copy trade seamlessly.

Why should you copy trade on Stand?

Speed, speed, speed. It takes time to get to conviction. It’s much easier to follow the top 5% of traders who account for the majority of a market’s gains. Often whales (anyone trading more than $5K) get material information on a market before anyone else.

It also takes time to find the right people to copy trade. You would never copy trade someone who has a history of losing!

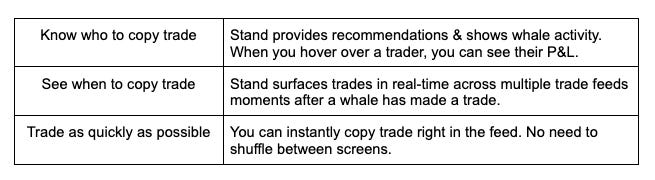

With Stand,

Stand helps you copy trade whales in real-time. We have two feeds that show you trades right as they are happening:

Live Trade Feed - a real-time stream of trades from people you follow.

Whale Watching - this is a discovery feed of all whale activity

Stand enables you to trade any other trader’s activity right in the feed. Plus, Stand gives you real-time notifications after any whale makes a move.

With intuitive UI and a feel for the prediction market experience, Stand is a no-brainer for copy trading Polymarket whales!

Why should you NOT copy trade?

You need to be careful around the market conditions. For example, automation can work in liquid markets, or markets that have a low spread between buyers and sellers. However, you can get burned trying to copy trade in illiquid markets.

For example, if Vitalik buys “Will Ethereum launch a token?” at $50 and the next available price to buy is at $100, you probably wouldn’t want to copy that trade (Note: Polymarket prices range from $0.01 to $100 on every market)! Believe it or not, that can happen in prediction markets where there aren’t a lot of buyers or sellers, or where buyers and sellers are far off on price (aka the spread).

A number of whales are rewarded on Polymarket for market making, narrowing the spread between buyers and sellers. Polymarket will pay those traders for taking positions on both sides of a market. You would be foolish to copy trade traders who are market making. Thankfully, on Stand, when you hover over a market in the feed, you can identify whether they are market making by seeing all their positions in a market.

You also need to be careful around who you copy trade. Context matters. Sports traders may have low success rates in election markets. With Stand, you can click into a traders’ profile and see their all-time Profit & Loss (P&L) in all positions.

Remember, always do your own research (#DYOR)! Be sure to check the price of what you are buying every time. And, like all trading, determine in advance how much you can afford to lose.

It’s important to remember that copy trading is one tool in the tool box of trading strategies.

Conclusion

The beauty of copy trading is even if you are a little late to the game, you still can catch a moving market closing towards resolution. And, you will learn as you go!

Sign up today at www.stand.trade!