When Should A Prediction Market Trader Use A Stop Order?

Buy! Buy! Buy! Sell! Sell! Sell!

Prediction markets move fast. Odds can swing on breaking news, insider information, or even the momentum of trader sentiment. For many participants, one of the most underutilized but powerful tools is the stop order. Stop orders also play a crucial role in prediction markets—especially as liquidity deepens and volatility increases.

Until recently, it wasn’t possible to place stop orders, but now you can on Stand! In this post, we will walk through a few scenarios where a trader might want to place a stop order and how you can set stop orders on Stand.

What Is A Stop Order?

A stop order is your instruction to buy or sell when the market hits a certain price. In other words, it protects you from having to monitor the market 24/7. For example, you might say: “If this YES share falls below 40 cents, sell my position.” Once that trigger price is reached, your order converts into a market order and executes.

Think of it as your guardrail—either preventing your losses from spiraling or locking in profits before the tide turns.

How Is A Stop Order Different From A Limit Order?

A limit order is where you set a specific price (ex. 55 cents) and your order is filled only at the price or a more favorable one for you. There is no guarantee of execution if your order fails to hit the chosen price point.

The cleanest illustration of a limit order is the ‘take profit’ order. Sometimes the hardest part of trading isn’t spotting the right market—it’s knowing when to get out. A take profit order can help you realize gains by automatically selling once your target price is reached. Instead of second-guessing yourself or getting greedy for a little more upside, you can lock in gains the moment the market moves in your favor, freeing you up to focus on your next trade.

When To Use Stop Orders In Prediction Markets

Protecting Against Sudden News Shocks

Prediction markets thrive on uncertainty. A Supreme Court ruling, a leaked poll, or a breaking tweet can shift probabilities instantly. Since you can’t always sit glued to your screen, a stop order lets you automatically cut risk if the market moves against you faster than you can react.Locking in Profits on a Winning Position

Say you bought shares of “Candidate X wins” at 30¢ and they’ve risen to 70¢ after a strong debate performance. You might want to stay in the trade for more upside, but you don’t want to watch profits evaporate if new polling flips sentiment. By placing a stop order at, say, 55¢, you ensure gains are secured even if momentum reverses.Managing Emotional Trading

Prediction markets, like sports betting or day trading, can trigger emotional swings. Stop orders help you enforce discipline. Instead of panic-selling when odds dip, or clinging to a loser because you “hope” it will bounce back, your stops execute the strategy you set in advance.Scaling Out of Large Positions

For whales or active traders, stop orders can be staggered at multiple price points. This way, parts of your position are sold gradually if markets decline, rather than dumping all at once and risking poor fills in thin liquidity.

When To Use Stop Orders In Prediction Market

Stand is an advanced trading terminal for prediction markets designed to help give you an edge over the competition. Beyond live trade feeds and alerts, you can also place stop orders on Stand. Here’s how it works.

Place a market order on any market

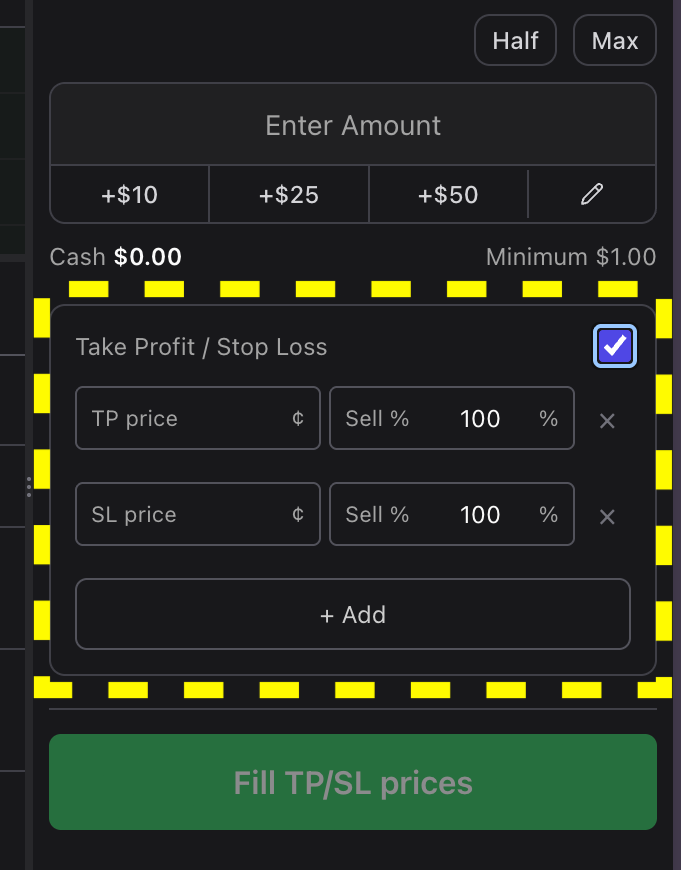

Select ‘Take Profit / Stop Loss’

Determine what price point you want to lock in a gain for ‘TP price’. You can choose how much of your position you want to sell.

or

Determine what price point you want to lock in a loss for ‘SL price’. You can choose how much of your position you want to sell.

IMPORTANT: You can set multiple TP & SL orders at different price points.Place the order

And voila! You have now set a stop order on stand. Super easy, right?

You can edit your orders at any time in your positions. You can also cancel open orders (only applicable to Take Profit orders).

Stop Orders Aren’t Foolproof

Remember, stop orders carry caveats in prediction markets:

Slippage: In fast-moving markets, the execution price may be worse than the stop level for you.

False Triggers: Temporary price spikes can trigger stops unnecessarily, causing a quick exit from the position.

Liquidity Risks: If order books are shallow, your stop could execute at a much less favorable price.

This is why many traders pair stop orders with limit orders, setting a maximum (or minimum) price at which the trade can be executed.

Conclusion

As a prediction market trader, stop orders are one of the most important tools in your risk-management toolkit. Thankfully, Stand has you covered here by making them dead simple to use. You can set percentages and multi-steps. On Stand, stop orders help you protect your capital, lock in profits, and keep emotions from driving your decisions in markets that can swing on a single headline. The best traders don’t just predict outcomes—they manage risk with discipline.

If you haven’t started using stop orders yet on Stand, it may be time to add them to your strategy.