Redeeming vs Splitting vs Merging Shares on Polymarket: What’s the Difference?

All the ways you can exit a Polymarket trade

If you’ve been snooping around other traders’ profiles on Stand, you may have noticed three unusual actions: Redeeming, Splitting, and Merging. They all serve different purposes depending on the positions traders hold. Understanding these differences can help you as a trader maximize your returns and avoid unnecessary steps.

When To Redeem Shares on Prediction Markets

Redeeming is the simplest option to convert your position. When a market resolves, i.e. ends, you can claim any winning/losing shares directly into USDC at a 1:1 ratio.

For example,

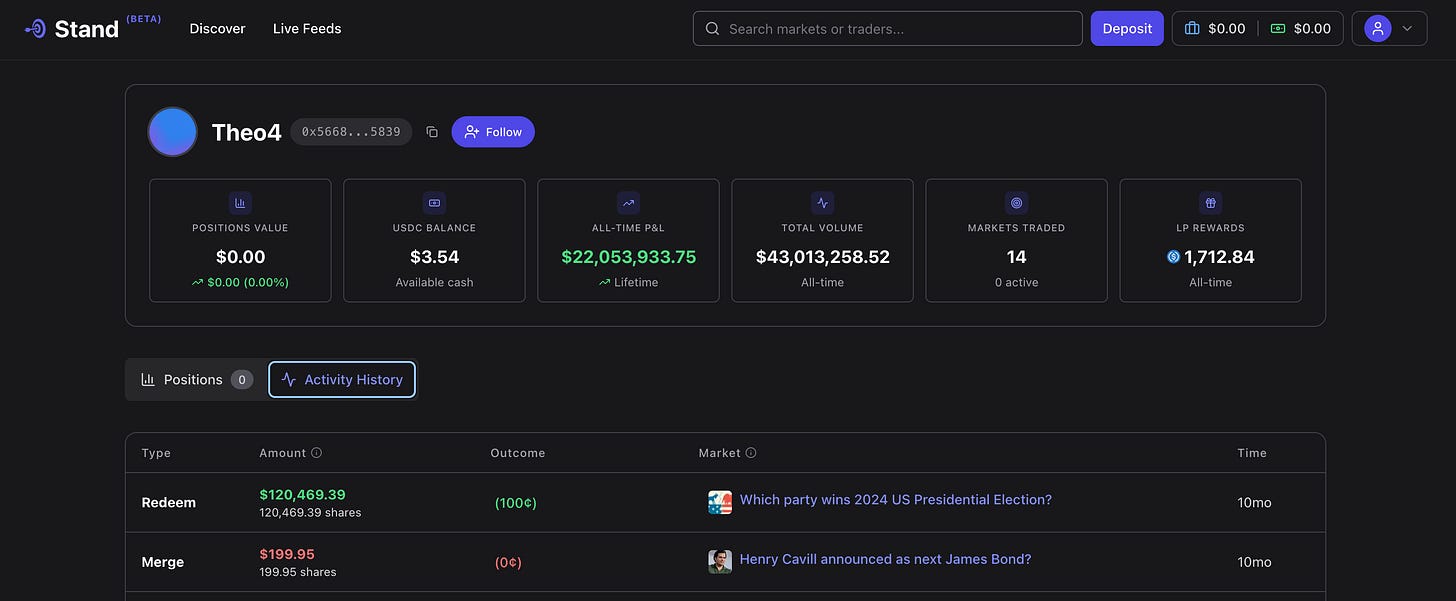

If Theo4 bet YES on the Republican Party winning the 2024 Presidential election and the market resolves YES, Theo4 can now redeem his 120,469 YES share for $120,469 USDC.

If Theo4 bet NO on the Democratic Party winning the 2024 Presidential election and the market resolves NO, each NO share Theo4 owns becomes 1 USDC.

Most traders will take this approach to close out a position. By redeeming their shares back to USDC, they can enter into another market or withdraw their funds entirely.

There are scenarios where redeeming may not make sense as we will cover in the next section.

When To Merge Shares on Prediction Markets

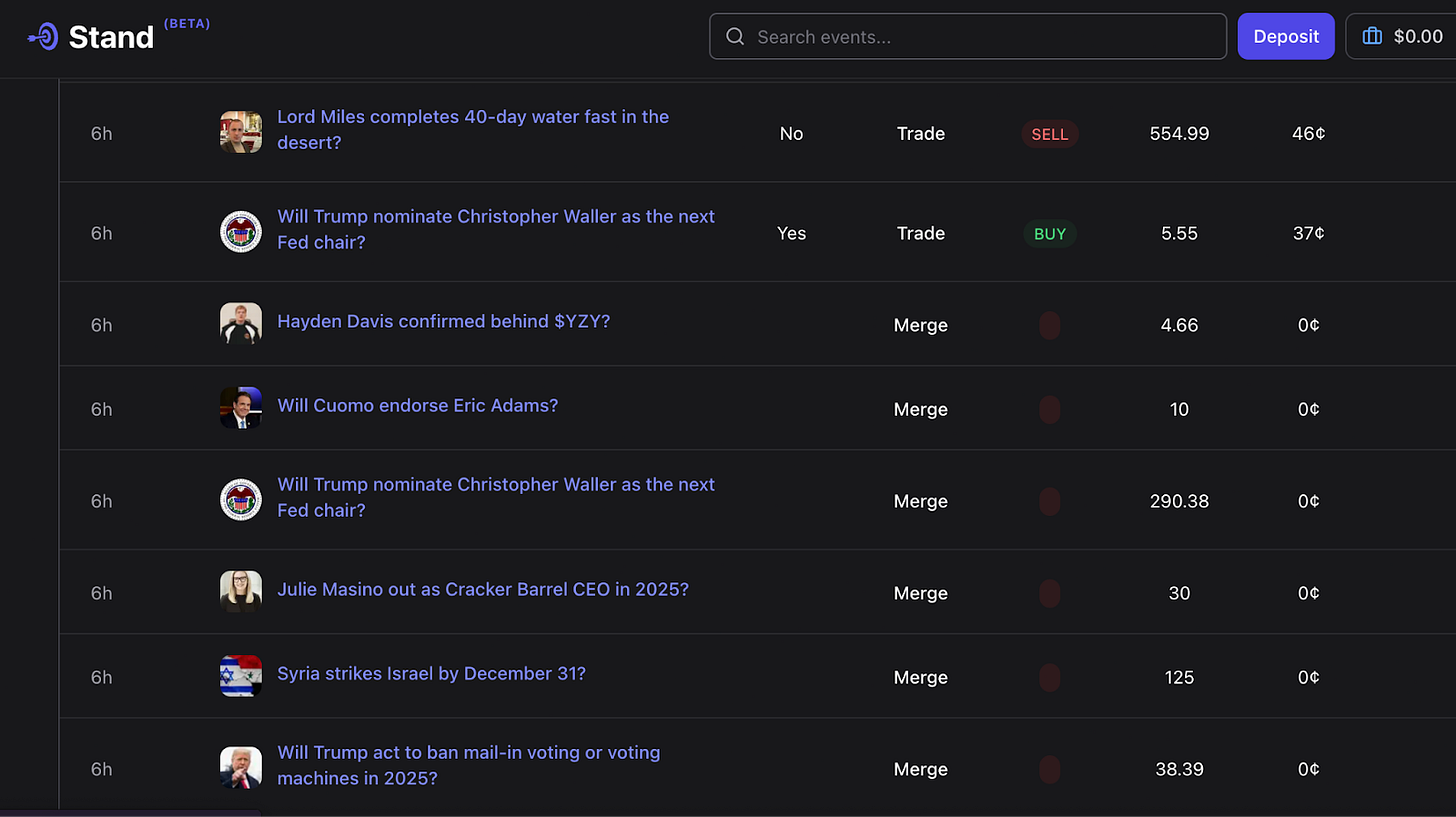

Say a market is over yet the winners are waiting to be paid out. This can happen from time to time when oracles are resolving the market or when a market is under dispute. Merging is when you hold both YES and NO shares in the same market — which often happens if you’ve been trading or market making (Polymarket, in particular, incentivizes traders to close spreads).

Merging allows you to combine equal amounts of YES and NO shares and redeem them for USDC.

For example, if the Zelenskyy suit market is under dispute, and you hold 100 YES and 100 NO shares, merging cancels them out and gives you 100 USDC. This avoids the hassle of selling your losing shares separately and provides instant liquidity by simplifying your settlement.

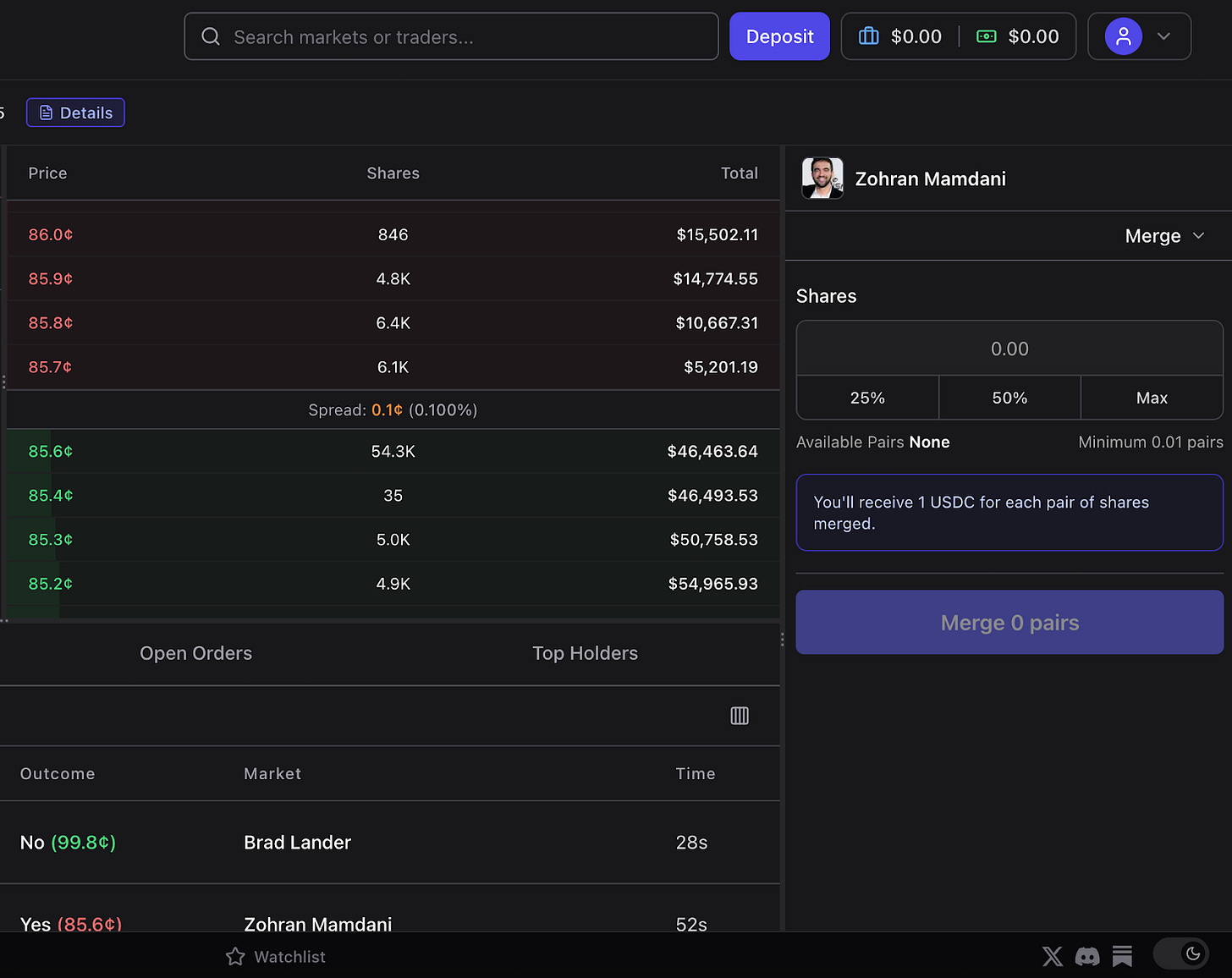

You can actually merge shares seamlessly in Stand! Simply click ‘Merge’ from the drop down and voila! Remember, it will only work when you have equal shares of both sides of a market.

When To Split Shares on Prediction Markets

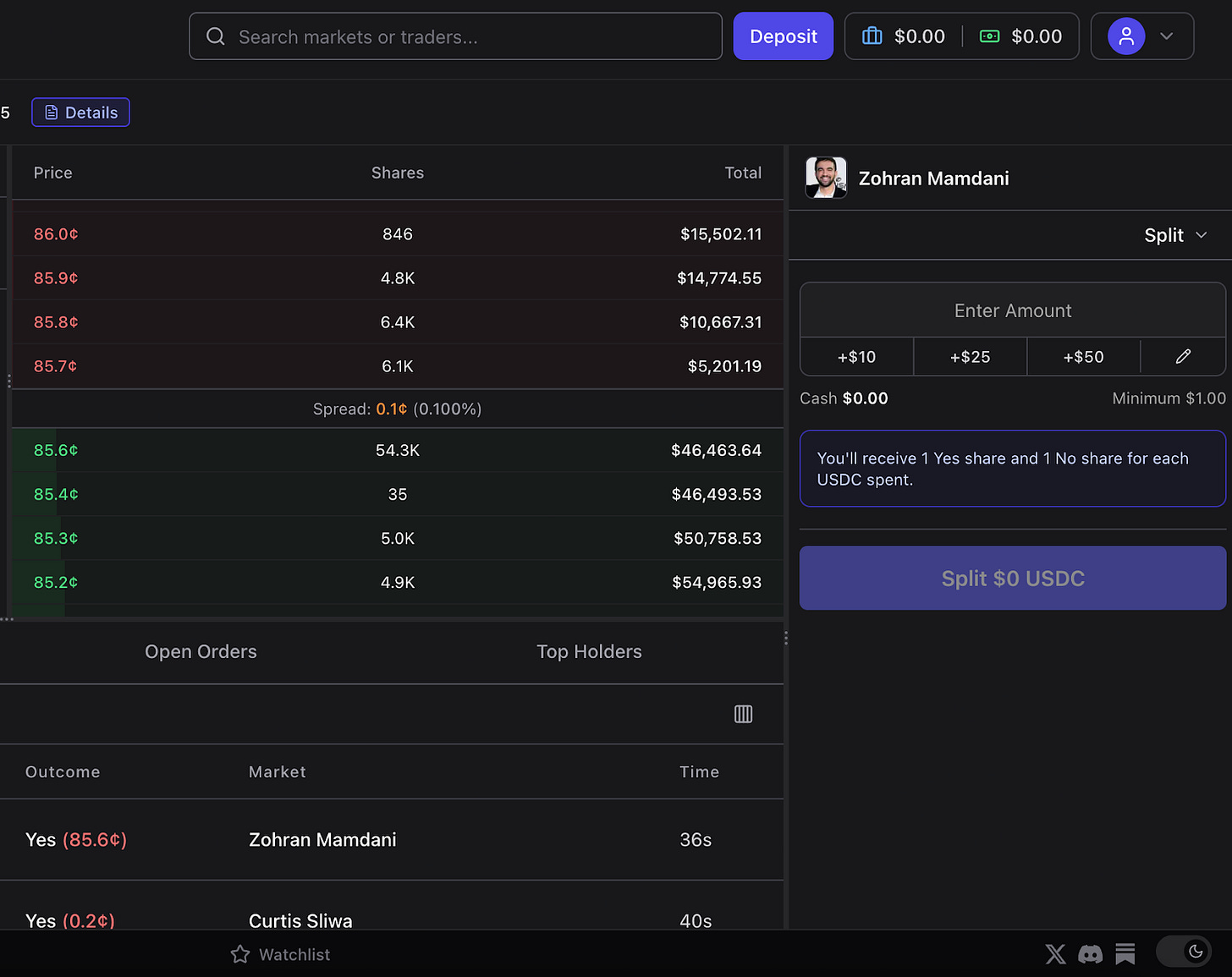

Splitting is the reverse of Merging. It converts 1 USDC into 1 YES and 1 NO share, which you can then trade independently.

Why would you want to split into an equal number of shares? Polymarket offers rewards for users who help narrow the spread between positions. Traders calculate which markets are lucrative to help narrow the spread and jump in to claim the rewards. This is called ‘liquidity providing’ or ‘liquidity mining’.

Splitting may also make sense in a market where liquidity is weak on one particular side. By being proactive, it makes merging all that much easier down the road for a quick exit:

Example: Split 100 USDC → receive 100 YES + 100 NO shares.

Merge 100 YES + 100 NO shares back to USDC

Stand makes splitting seamless too! Like with ‘Merge’, all you have to do is click on ‘Split’ from the drop down in the trading panel. It will tell you the minimum required to split into both sides of the market.

In Closing

Redeem your position in a market that has cleanly resolved or in one where you don’t have positions on both sides. This is what most traders will do.

Split USDC into balanced sets of YES and NO shares for the same market. This is common for liquidity providers seeking reward incentives.

Merge your position if you have both sides and want to settle cleanly before a market resolves.

Knowing when to use each option helps you manage your portfolio efficiently and avoid leaving value on the table. Stand allows you to do all three actions easily AND provides real insight into when traders do either, particularly in the case of liquidity mining (i.e. when traders put up capital to close the spreads and earn rewards).

Just one more way that Stand has your back. Try it yourself today!