70% of Prediction Market Traders Lose Money. Counter Trade Them for Free on Stand

Zero-fee copy/counter trading has arrived on Stand

The beauty of onchain finance is you can witness others’ transactions and follow them into battle. Copy trading is not new to web3 or prediction markets. Investors are always looking for alpha whether it’s crafting their own theses or tracking US politicians via vehicles like the Nancy Pelosi Stock Tracker.

Stand always had its sights on copy trading, however, we had to do it in a way that would *actually* profit users. The popular accounts know they are being watched. In fact, most whales have multiple accounts. They could easily buy 1¢ position in an illiquid market and then buy it from their ‘main’, watched account. All they would have to do is flip it back and dump on all the copy traders. It’s an easy way to get rekt.

To tackle copy trading, Stand incorporated new elements to raise the game and give pro traders the best tool possible to conduct sophisticated strategies. Here’s how copy (and counter) trading is superior on Stand.

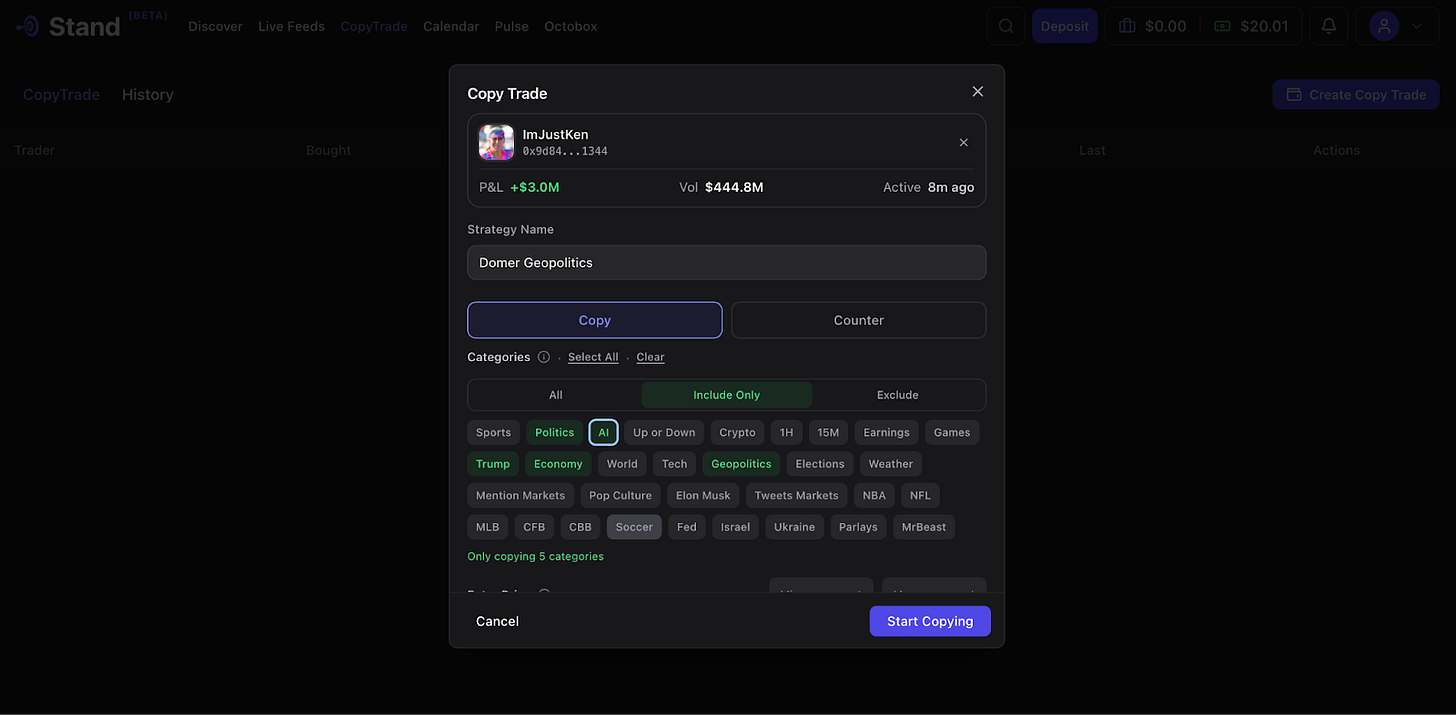

(1) Counter Trade - if you can’t beat ‘em, bet against ‘em!

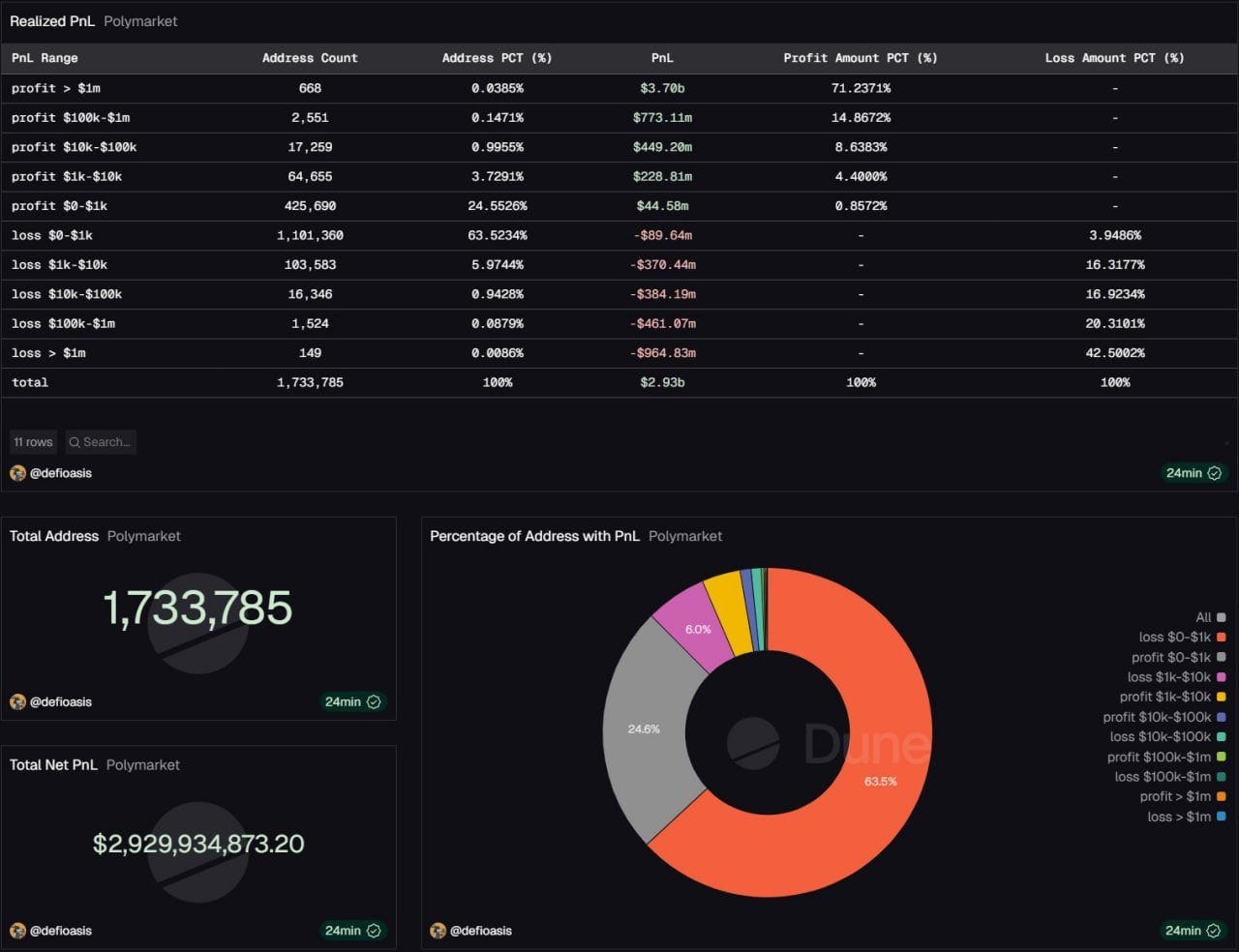

70% of the 2M traders on Polymarket have a negative P&L. That means everyone knows the good players and the good players know they’re being watched. But it also means a more lucrative strategy might be to go against the herd and profit off the habitual losers.

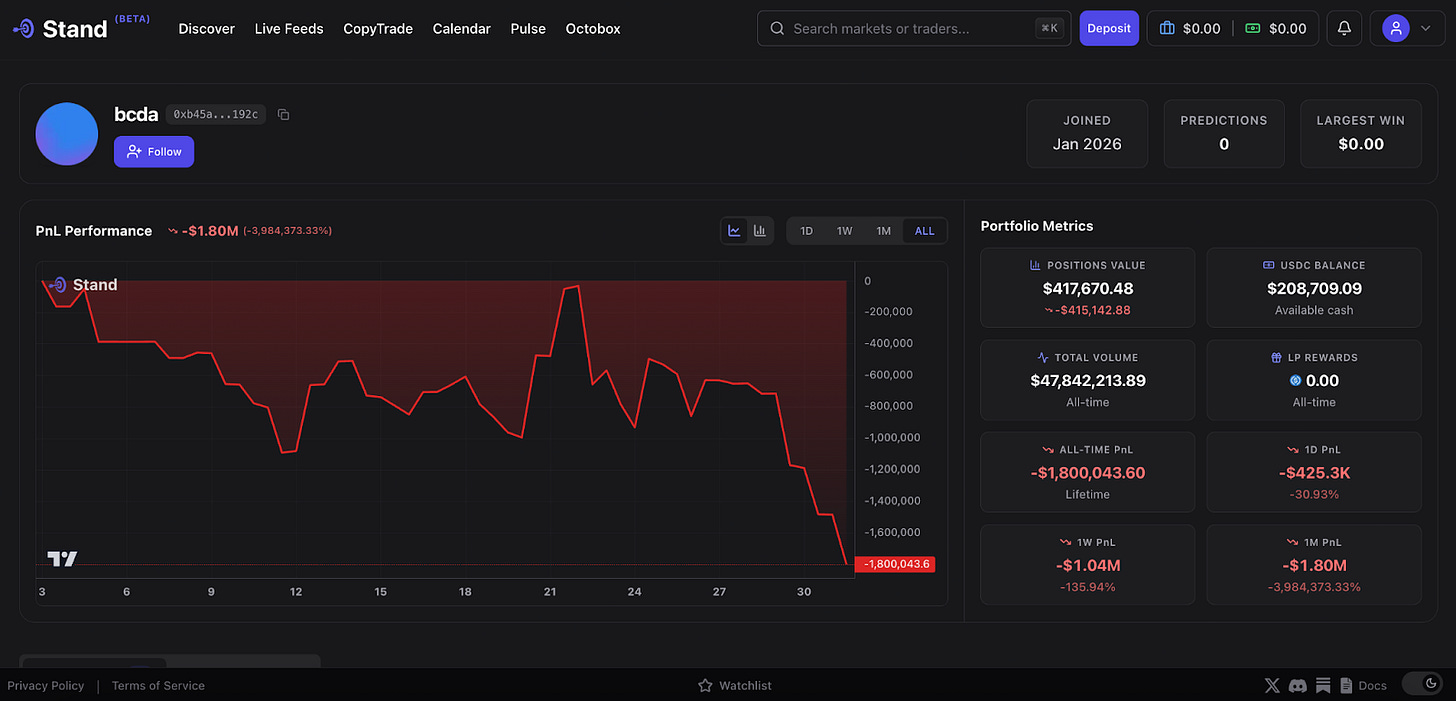

Take bcda, statistically one of the worst NBA traders on Polymarket. They have lost $2.4M lifetime, $1.4M of which was on NBA markets. That makes bcda the perfect trader to counter trade.

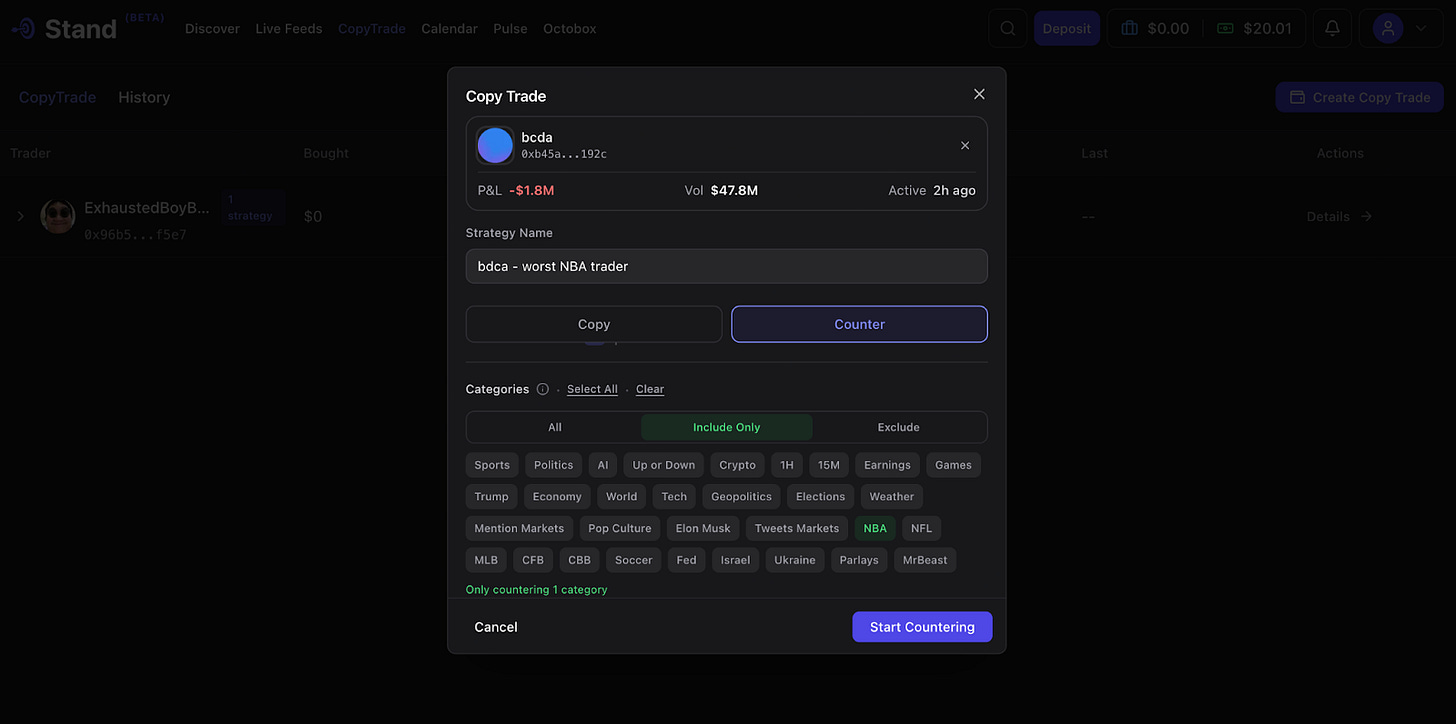

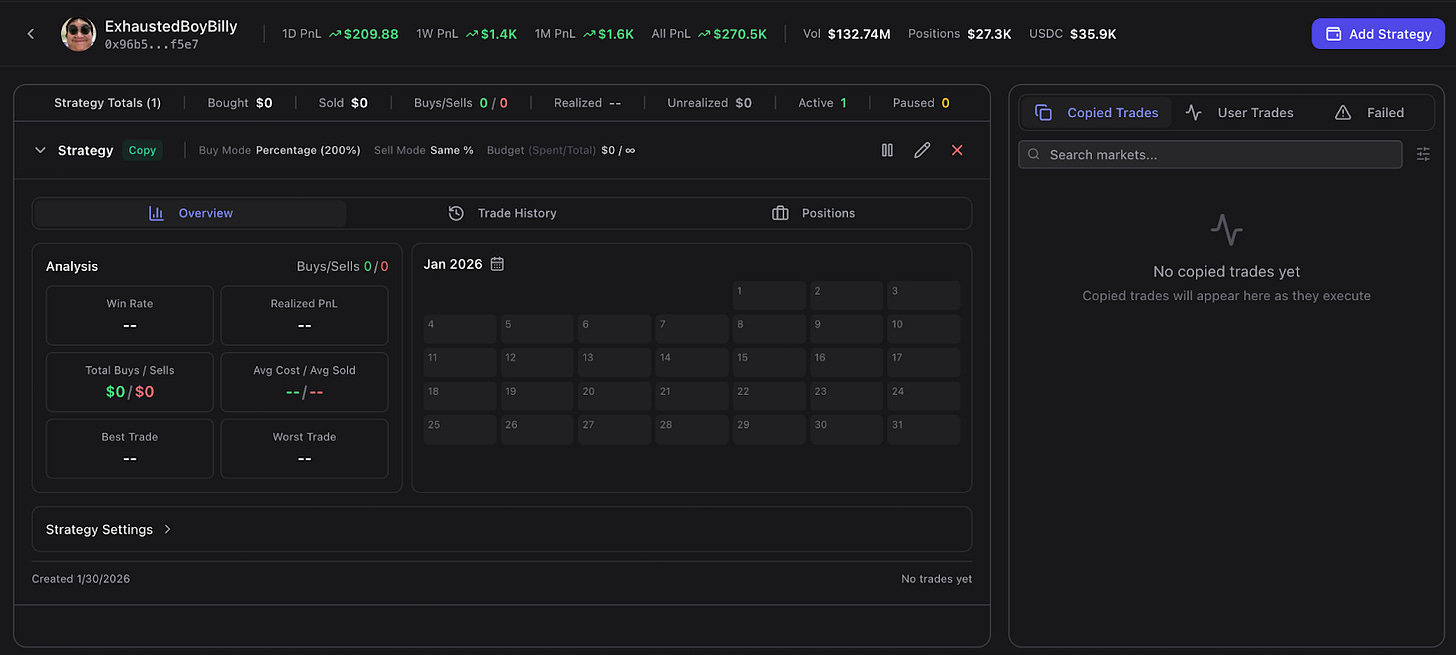

Setting up counter trading is easy on Stand. Use the category filters to narrow your strategy to specific markets.

And voila! It’s time to start counter trading bcda.

(2) Set Up Multiple Strategies

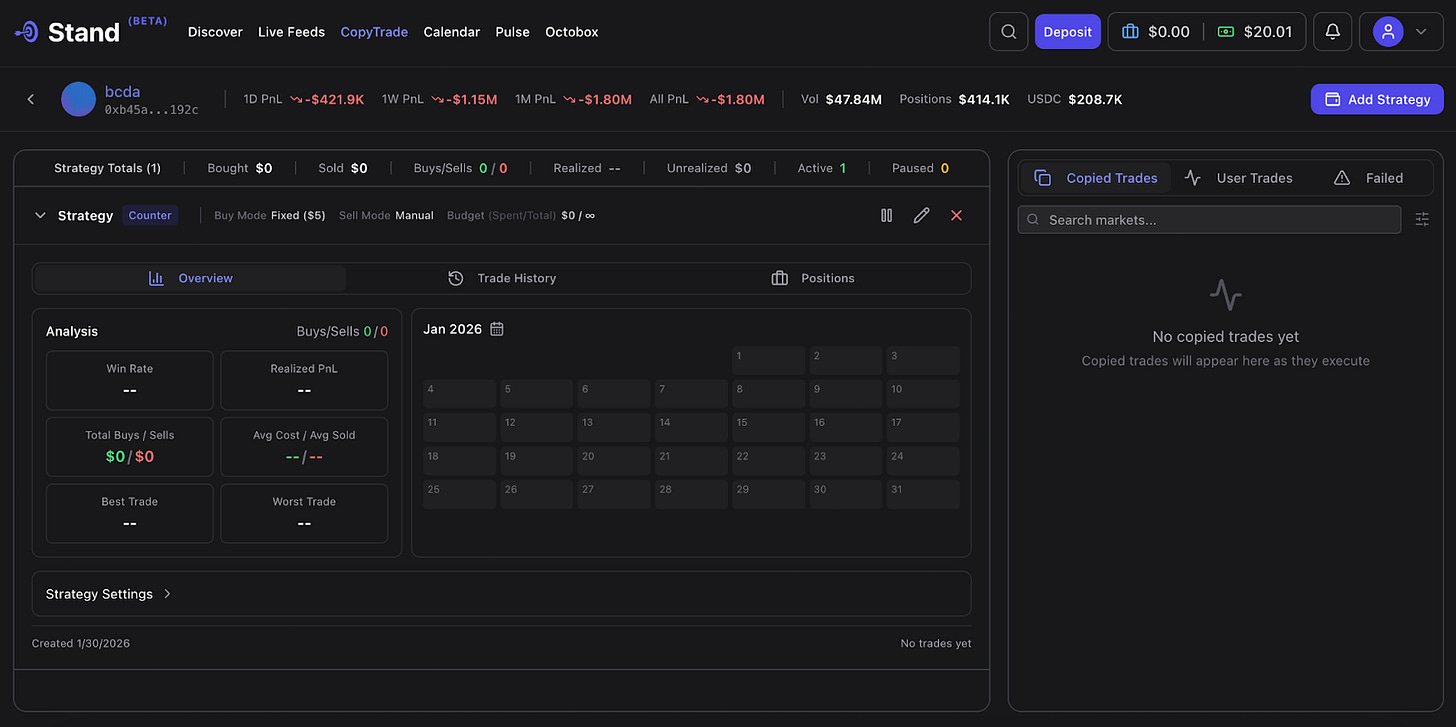

Copy trading on Stand can be so much more than a blind follow on all of a followed traders’ trades. You can set all types of conditionals to execute your desired trade order.

For example, on Stand’s copy trade you can choose if you want to buy as a percentage, range, or fixed amount of your followed trader. Set your entry price, slippage, volume amounts, market resolution time frames, how long you want to copy trade for, and how to exit a copy trade.

Best of all, you can set competing or differentiated strategies for the same traders.

(3) Category Filters

Other copy trading bots blindly copy all of a traders’ trades. That’s bad. What if a Fed Rate trader (Win Rate > 70%) tries his luck on the Mention Markets (Win Rate < 20%)? Again, you’ll get rekt. To avoid this, you can set individual categories for each trader you copy trade on Stand. Follow sports traders when they enter sports markets and nothing else.

(4) No Fees

To make copy trading a pure magical experience, Stand is launching it with no fees. 0% fee on copy trading.

We understand how margin sensitive pro traders are. Others may promise fancy tiered rewards while Stand protects traders’ bottom lines.

N.B. While Stand allows trading on Kalshi and Polymarket, copy trading is only allowed on Polymarket at present.

In Conclusion

Every product decision Stand makes is to empower traders with the most sophisticated trading tools out there. Copy trading is a powerful tool in the tool box when executed correctly. This is Stand copy trading v1. Please tell us what we can do to improve. And, remember, the bottom line on Stand is always the same: for the betterment of the trading community.